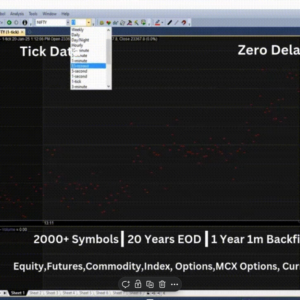

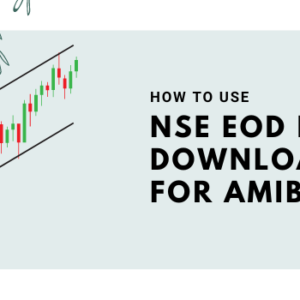

Looking to supercharge your trading analysis with comprehensive amibroker historical data? The ability to download 20 years of NSE EOD data for Amibroker is a game-changer for serious traders and analysts. Whether you’re developing trading strategies, conducting technical analysis, or diving into algorithmic trading, having access to extensive historical data is crucial for making informed decisions.

Key Takeaways

- Complete walkthrough for downloading and integrating extensive NSE amibroker historical data into Amibroker for technical analysis and algorithmic trading

- Essential setup requirements for Amibroker’s real-time data feed and configuration steps for seamless implementation

- Practical applications focusing on strategy backtesting, portfolio management, and making correct trading decisions

- Detailed information about data feeder software, including AmiBroker data feed and tickbytick software integration

- Guidelines for accessing live data feeds and EOD data for both equity and future markets

Understanding EOD Data and Its Importance

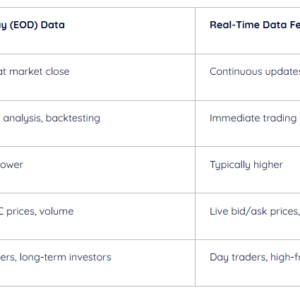

End of Day (EOD) data represents a comprehensive collection of trading information from the National Stock Exchange after market hours. This data serves as a crucial resource for traders, investors, and analysts who rely on historical market information for their decision-making processes.

What is NSE EOD Data?

NSE EOD data includes vital trading metrics like opening price, closing price, high, low, and trading volume for all listed securities. This information is recorded at the end of each trading day, providing a snapshot of market activity. The data helps traders understand price movements, market trends, and trading patterns over extended periods.

Significance in Market Analysis

Amibroker historical data spanning 20 years offers invaluable insights into long-term market behavior. It enables traders to identify cyclical patterns, seasonal trends, and market anomalies that might not be apparent in shorter timeframes. This extensive dataset helps in developing robust trading strategies and making informed investment decisions.

Benefits for Trading Systems

Access to two decades of market data proves instrumental in building and testing trading systems. It allows traders to:

– Validate trading strategies across different market conditions

– Analyze market behavior during various economic cycles

– Identify recurring patterns and trends

– Test system performance during bull and bear markets

– Optimize trading parameters for better results

Role in Risk Management

Long-term amibroker historical data plays a crucial role in risk assessment and management. It helps traders understand:

– Maximum drawdown scenarios

– Volatility patterns during market stress

– Correlation between different market segments

– Historical risk-reward ratios

– Market behavior during extreme events

Setting Up Amibroker Historical Data

Software Requirements

Before diving into historical data analysis, you need to set up two essential components. First, install Amibroker, a powerful technical analysis software. Second, get AmiProfits Feeder, a specialized tool for downloading NSE EOD data. These tools work together seamlessly to provide comprehensive market analysis capabilities.

Make sure your system meets the minimum requirements for smooth operation. A stable internet connection is crucial for consistent data downloads. Additionally, ensure you have sufficient storage space to accommodate 20 years of amibroker historical data.

Configuration Process

Start by launching Amibroker and navigating to the File > Database Settings menu. Here, you’ll need to create a new database specifically for NSE data. Select an appropriate location on your hard drive with ample space.

Next, configure AmiProfits Feeder by entering your login credentials and selecting your preferred data package. Connect it to your Amibroker database by specifying the correct database path. This ensures seamless data integration between both platforms.

In the AmiProfits Feeder settings, choose your desired timeframe for historical data download. You can select specific date ranges or opt for the complete 20-year dataset.

Remember to set up automatic daily updates to keep your database current. This ensures you always have the latest market data for analysis. Regular maintenance checks help identify and resolve any data gaps or inconsistencies.

Real-Time Data Integration

The integration of real-time data with Amibroker transforms it into a powerful live trading platform. This seamless connection ensures you’re always trading with the most current market information, essential for making informed decisions.

Setting Up Real-Time Feed

AmiProfits Feeder acts as the bridge between live market data and Amibroker. The setup process involves configuring your data feed parameters and ensuring proper connectivity. Once established, you’ll receive continuous price updates, volume data, and market depth information directly in your Amibroker platform.

Live Market Monitoring

With real-time integration, you can monitor market movements as they happen. The system updates charts, indicators, and trading signals instantly, allowing you to spot opportunities and react to market changes immediately. This live monitoring capability is crucial for day traders and short-term investors who need to make quick decisions.

Automated Trading Execution

Real-time data integration enables automated trading systems to execute orders based on predefined conditions. When your trading strategies detect specific patterns or indicator signals, they can automatically place orders through your connected trading platform. This automation eliminates emotional decision-making and ensures consistent strategy implementation.

Data Quality Assurance

The system performs continuous checks to maintain data accuracy and reliability. It automatically validates incoming data against multiple parameters to prevent errors or gaps in your trading analysis. Regular data verification ensures that your trading decisions are based on accurate, up-to-the-minute market information.

Advanced Analysis Capabilities

The integration of 20 years of NSE EOD data into Amibroker opens up powerful analytical possibilities that can transform your trading approach. This comprehensive dataset serves as the foundation for sophisticated market analysis and strategy development.

Technical Analysis Tools

Amibroker’s advanced charting capabilities allow you to visualize long-term market trends with precision. You can apply multiple technical indicators simultaneously, from simple moving averages to complex oscillators, across extended timeframes. The platform enables pattern recognition across decades of market data, helping identify recurring market behaviors and potential trading opportunities.

The ability to analyze historical price movements across different market cycles provides invaluable insights into market behavior. You can study how specific patterns have performed during various economic conditions, from bull markets to bear markets, and everything in between.

Strategy Development and Optimization

With access to 20 years of market data, you can develop and refine trading strategies with unprecedented accuracy. Amibroker Formula Language (AFL) allows you to code custom indicators and trading systems, testing them against extensive historical data to ensure reliability.

Amibroker’s optimization engine helps fine-tune strategy parameters using two decades of market data. This extensive testing period helps avoid curve-fitting and ensures your strategies are robust across different market conditions. You can backtest multiple variations of your trading systems, analyzing their performance through various market cycles to identify the most consistent approaches.

The platform’s walk-forward analysis capabilities let you validate your strategies using out-of-sample data, providing a realistic assessment of how they might perform in live trading conditions. This comprehensive testing approach helps build confidence in your trading systems before deploying them in real markets.

Risk Considerations and Support

Data Reliability Concerns

When working with Amibroker historical data , it’s crucial to understand potential data quality issues. Market data can sometimes contain gaps, adjustments for corporate actions, or occasional errors. Regular verification of data accuracy through cross-referencing with official sources helps maintain reliable analysis results.

Technical Requirements

Your system should meet specific hardware requirements to handle large datasets spanning 20 years. A minimum of 8GB RAM and sufficient storage space is necessary for smooth operation. Stable internet connectivity is essential for consistent data updates and backfilling processes.

Available Support Channels

Multiple support options are available for users implementing NSE EOD data in Amibroker. These include:

– Official documentation and user guides

– Anydesk support 24/7

– whatsapp support for technical queries

– Video tutorials for step-by-step guidance

Conclusion

Accessing 20 years of NSE EOD data for Amibroker is a powerful tool that can revolutionize your trading journey. With comprehensive historical data at your fingertips, you’re equipped to make more informed trading decisions through robust backtesting and technical analysis.Your journey to more informed and data-driven trading decisions begins here.

FAQs

Is historical data in Amibroker suitable for both intraday and positional trading analysis?

Historical data in Amibroker is ideal for both trading styles. For intraday trading, you can analyze minute-by-minute patterns, while for positional trading, EOD data helps identify long-term trends. The technical analysis platform offers versatile timeframe options to suit different trading strategies.

How often is the historical data updated in Amibroker?

The EOD data is updated daily after market hours, typically within 30 minutes of market closing. For real-time traders, live data feed updates occur instantly through the data feeder app, ensuring accurate and timely information for making correct trading decisions.

Can I export Amibroker historical data to other trading platforms?

Yes, Amibroker supports data export in various formats, including MetaStock data format. This flexibility allows active traders to use the historical data across different algorithmic trading platforms while maintaining data integrity and accuracy.

What happens to my historical data if I change my subscription plan?

Your downloaded historical data remains intact even if you change or pause your subscription. However, you’ll need an active subscription to receive new updates and live data feed. The existing data stays in your local database for continued analysis.

Is the historical data adjusted for corporate actions like splits and bonuses?

Yes, the NSE EOD data is fully adjusted for corporate actions including stock splits, bonuses, and dividends. This ensures accurate backtesting results and reliable technical analysis for stock market traders using the platform.

How much storage space is required for 20 years of historical data?

The storage requirement for 20 years of NSE EOD data is approximately 5-7 GB, depending on the number of symbols and data points. It’s recommended to have at least 10 GB of free space for smooth operation of the Amibroker software with historical data.

Add a Comment