The goal of this tutorial is to teach you what is Amibroker and Amibroker data feed in a few minutes. This is not a comprehensive Amibroker data lesson, but it does cover all of the elements that I believe are most useful for trading.

This is the course for you if you want to learn how to utilize the Amibroker data feed.

What is Amibroker? And Where to Get Amibroker Data Feed?

Amibroker is a strong tool for technical analysis and backtesting. You may use the program to scan, produce charts, and execute portfolio-level backtests.

You can accomplish anything you want with an Amibroker data feeder with a little amount of code. However, the major reason I choose Amibroker is its quickness.

Ami feeds can execute backtests more efficiently than other platforms since it uses array processing.

This gives the ability to test new trade ideas quickly. This is important since I don’t want to waste time on trade ideas. I want to put a concept to the test, see whether it works, and then move on.

The rest of this post will teach you how to get started with Amibroker data feed India.

(You can get an Amibroker data feed at a reasonable price from Amiprofits.)

Amibroker Data Feed Installation And Setup:

The first step is to go to Amibroker or Amiprofits and purchase and download the program. You may also participate in the Amibroker data feed free trial so that you can trade using the Amibroker data feed free for 3 days.

After purchasing Amibroker live data you will also need to get Amiquote, an Amibroker data plugin that imports free historical data.

The plugin imports the data directly into the Amibroker data feed, allowing you to perform your analysis.

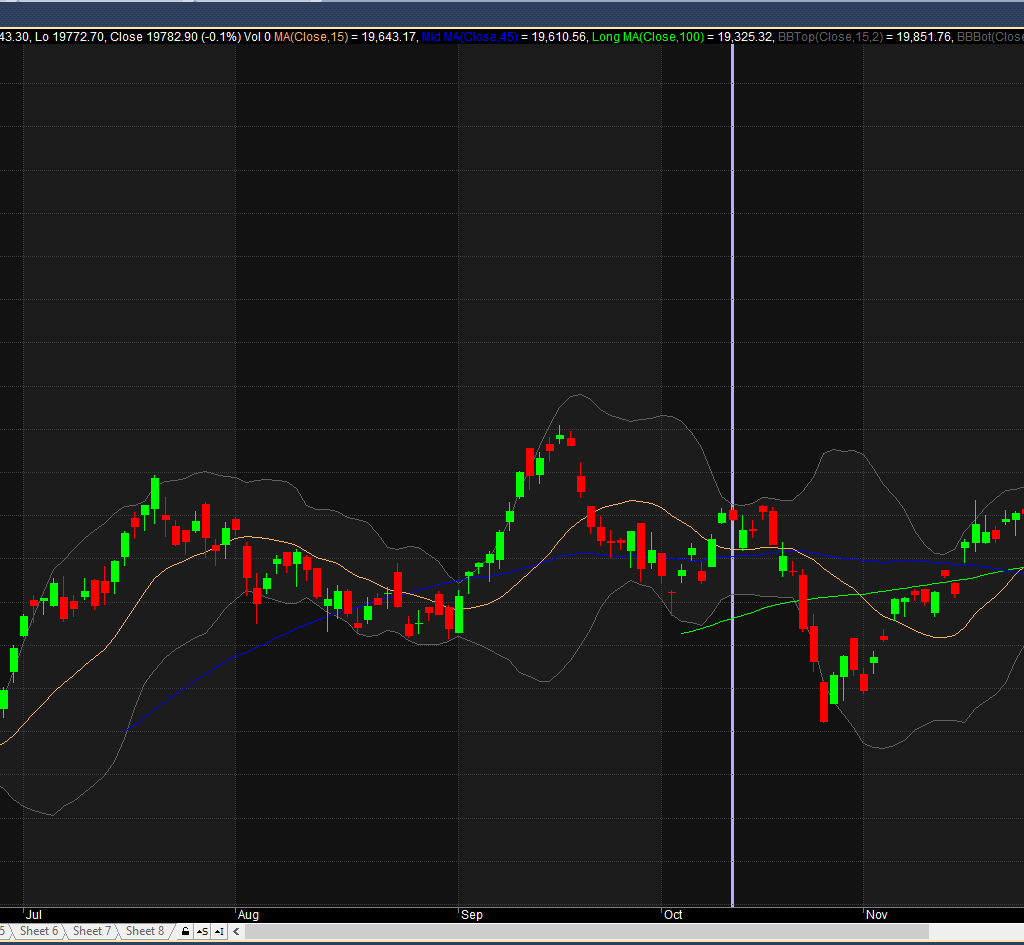

After you’ve installed everything, open Amibroker, and it should look like this,

- You’ve got a regular Windows configuration right immediately.

- On the primary price chart window with technical indicators, on the left side, you have your symbols, chart choices, and information.

- One of the first things you should do is change the appearance of the charts and the layout of your windows.

- You may alter a variety of options, such as charting, axes/grids, colors, and so on, by going to Tools >> Preferences.

- When you click Window on the main toolbar, you may choose which windows to keep open and which to close. You may also choose whether the windows are fixed or floating.

- The term “floating” refers to the ability of windows to be moved around on multiple displays.

- If you look at the symbols list on the left, you’ll notice that a database is already installed. Some US stock tickers, such as Alcoa, Boeing, and Citigroup, have filled up. This is the standard Amibroker database that comes with the software.

Learn Amibroker Databases:

Amibroker uses databases for trades. What you receive out of Amibroker live data is only as good as the data you enter.

To create a new database, select File >> New >> Database. This is where you create the database of stocks for your research and backtesting.

When you create a new database, you can choose to import data directly from a third-party plugin.

Not just daily prices, but also other time ranges, may be imported. You may even go as low as one minute and, if desired, tick data. The shorter the term, the larger your database will get.

So, if you want 5 years of 1-minute data, you should set the number of bars to around 650,000. If you have 20 years of EOD data, the number of bars should be around 5,500.

The Amibroker import wizard (File >> Import Wizard) is extremely handy for importing any data that is in a format other than CSV.

The wizard may be used to import stock data, sentiment data, fundamental data, and so forth. This implies you won’t require a third-party plugin to import your data.

Amibroker Data for Free:

If you want historical data but don’t want to pay for it, Amiquote is one alternative.

The first step is to establish a new database and name it something like “S&P 500” or “Amiquote Data.”

Then you launch Amiquote, which will download data from one of the various sources and import it directly into your Amibroker database.

All you have to do is go to File >> Save As. Open and close a list of ticker symbols. In the Amiquote folder, you’ll find items that have already been installed for you.

They are in the tls file format. Here is a list of NASDAQ 100 tickers already created.

Set a date range and a data source, such as Yahoo! Finance, after you have your list of symbols. Then, to begin the download, click the green arrow.

This will populate your Amibroker database with data for all of the ticker symbols.

Each ticker may be imported into the Amibroker data feed the next time you open it by clicking on the symbol box at the top.

The tickers can also be accessed using the Symbols window. You’ll see that the Amibroker data feed is now populated with data for all of those stocks.

What are the Problems with using Amibroker Free Data?

Before we continue, I should mention that free data is excellent for starting. The majority of the time, it is fairly accurate.

However, there are several drawbacks to using free data that you should be aware of. This is especially true when dealing with less liquid assets, such as small-cap stocks.

Free data isn’t always trustworthy. It has flaws and is not always updated to reflect business actions such as stock splits.

Stock splits, in particular, might cause big price gaps in your historical data that do not exist.

To do a real backtest, you will need to pay for data that has been properly modified and cared for.

As previously stated, there are several data suppliers available in that Amiprofits is an excellent choice for Amibroker data feed users.

Amibroker Tutorial – Charting:

Without a look at charts, learning how to utilize the Amibroker data feed would be incomplete. Amibroker has a plethora of technical analysis tools and indicators that we may use.

When you choose a stock symbol, the data in the main chart pane will appear. However, your mouse over any price bar and a little window will appear with valuable information such as the date, open, high, low, and closing price.

If you want to add technical indicators, simply go to the charts box on the left and select what you want. For example, drag a moving average from the left and drop it on the chart.

This will bring up several parameters that can be changed. The moving average can be configured to use the close price or anything different. You may also change the bars, colors, and styles.

When you click OK, the moving average will appear as an overlay on your price chart.

As you will see, there is a vast library of pre-built indicators such as Bollinger Bands, MACD, RSI, MFI, and so on. You may also use Amibroker’s formula language to generate your own indicators.

To zoom in, use the green + arrow on the right-hand side. Just below that, you may choose between daily (d), weekly (w), or monthly periods (m).

Chart Panes:

The price chart in the center is referred to as a “window pane.” There are three panes in the graphic below. The top pane is occupied with a pricing chart.

The volume is displayed in the center pane, while the MACD indicator (moving average convergence divergence) is displayed in the bottom pane.

If you right-click on any of these panels, you’ll get several handy choices.

For example, if you right-click on the price chart, you may change any of your settings, such as moving averages. You may also make changes to the formula or remove any of the indicators.

You may also rearrange the panes, increase their size, or eliminate them entirely.

If you accidentally close a pane and find yourself without a pricing chart, Return to the chart window on the left and select the Basic Charts option. To open a new pane, double-click on any of these things.

Price (all in one) displays the price chart for the selected ticker, including Bollinger Bands, volume, and moving averages. In contrast, if you double-click “Simple Price,” the default price chart will be returned to your main chart window.

When you double-click Price, you’ll be able to plot a different symbol from the one you’ve previously chosen.

This procedure applies to everything in the chart window. Everything, whether it’s a price, a volume, or an indication, will rise. If you double-click it, it will open a new window.

Amibroker Sheets:

Sheets can be used in addition to chart panels. On each page, you can have a distinct set of charts and indicators. There are eight sheets available, and each one may be renamed.

You may also expand the number of chart windows. If you go to File >> New >> Default Chart, a new chart window will appear in its own tab. You may change the symbol and then compare the differences between the two charts.

When you have many chart windows open, you may cascade them by clicking the Window Menu. The windows can be arranged vertically or horizontally. You may even make the windows float and distribute them across many monitors.

A handy feature of the chart windows is the ability to lock a chart with a padlock. If you alter the symbol in the symbol window, the symbol on that chart will no longer update.

Charts can also be linked together. As a result, if you change the symbol link to blue, every other chart with a blue symbol link will return to the same symbol.

Windows Start Menu:

If you accidentally close a window, you may reopen it by selecting the Window option from the menu.

The Charts panel allows you to configure the various price charts. The Symbols pane allows you to browse across various marketplaces and watchlists to discover the symbols you’re looking for.

Symbol Information will provide extra information about the stock you’ve chosen, such as the firm name, address, and GICS.

The current workspace may be saved in layouts. If you save this layout locally by clicking right and then Save As so you’ll be able to reload it if it changes.

You may load this layout into a separate database if you right-click Global Layouts and save it.

Drawing tools for Amibroker:

Amibroker also includes a set of drawing tools. Trend lines, horizontal lines, channels, pitchforks, and circles are all examples of graphs. To eliminate them, simply right-click and choose “Delete All Studies.

There are other drawing tools for indicators such as Fibonacci extension, Fibonacci arc, Gann square, Gann arc, and so on.

As previously indicated in this Amibroker lesson, you can also design your own indicators in the formula editor.

After you’ve written the code for your formula, you can apply it to the chart or insert it into its own pane by clicking Apply Indicator or Insert Indicator. Indicators can also be stacked on top of one another.

Menus:

The View menu on the toolbar allows you to toggle the crosshair on and off, as well as adjust the chart style and size. You may also accomplish this by right-clicking.

Insert:

Insert is another method for inserting drawings such as trend lines, zig-zags, and indicator lines that we discussed before. The format is compatible with the drawings you place on the chart.

Symbols:

You may handle the many tickers in your database. You may add new symbols, delete existing ones, and establish watchlists. You may also view the real quotations for each symbol in the quote editor.

This allows you to correct any inaccuracies in the quotations that you have discovered.

Analysis:

Analysis is where you may use the formula editor to create new analysis windows. This is where you conduct all of your strategy creation and coding, and we’ll go over it in more detail in the next few parts.

As is typically the case, the easiest way to learn the Amibroker data feed is to get right in and start exploring.

Tools:

Menu is where you may purge your database, keep indicators up to date, and install third-party plugins. You can also access Preferences from this menu to customize your configuration.

You may choose the color of your charts and candlesticks, as well as the time intervals.

One item to consider is the decimal settings and the base currency. If you’re trading stocks in the United States, you’ll probably want to keep the currency as USD.

However, if you are trading equities from other nations, this may need to be updated to the native currency of the relevant country.

Useful Tips:

- When you click the small pin symbol on any of the side windows, it minimizes and moves them to the edge. If you’re running out of screen space, this is a lifesaver. To keep them in place, hit the pin again.

- Instead of using the arrows, use your mouse’s scroll button to travel along with the price chart. You may zoom in and out of the chart by holding CTRL + SCROLL at the same time.

- Holding down SHIFT and clicking the mouse on the Y-Axis of the price chart will allow you to modify the chart’s scale so that you can view all of the price values more readily.

- To bring up a lot of options, always use the right-click on the mouse to select a variety of alternatives. For example, if you like a certain chart style, right-click it and save it as the default chart.

- Double-click anywhere on the price chart to make two vertical markings (green and red) to help you recall noteworthy events or time ranges. To erase the lines, double-click them a third time.

Conclusion:

This article serves as a primer for learning Tick by Tick data for Amibroker. It covers the aspects of Amibroker that I believe are most important for success.

When developing a system, set aside some time to debug it, go through each trade, and ensure that it does what you want it to do.

Concentrate on the ultimate outcome and work backward to determine the next stages. There are usually several approaches in the Amibroker data feed.

Allow yourself some wiggle room in terms of slippage and trading expenses, and be wary of outcomes that appear too good to be true.

Make careful you use high-quality data and avoid over-optimization. Concentrate your efforts on locating strong tactics rather than visually appealing backtests

Finally, always paper trade a system before going live, since this is likely to reveal any errors that you would have missed otherwise.

Amibroker data feed is a great tool, but it should not be used in place of common sense and actual experience.

Get 500+ Amibroker AFLs for intraday and positional trading, as well as our Amibroker Data Feeder, for free from Amiprofits.

If you have any questions about the installation, we at Amiprofits are always here to help you via chat and WhatsApp.